With the passage of the Affordable Care Act, health care is now reported as part of your tax return. That means record keeping is even more important than ever. In years past people have switched plans and never even thought about the importance of keeping proof that they had the previous plan. From this point forward you will need to keep those old insurance cards right along with your tax receipts. If you are audited by the IRS, proof of insurance will need to be given just like your W-2. According to the IRS website: “keep records for three years from the  date you filed your original return or two years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return.” * Certain exceptions apply for record keeping. See www.irs.gov for more details or contact us. Remember to keep a file for medical expenses.

date you filed your original return or two years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return.” * Certain exceptions apply for record keeping. See www.irs.gov for more details or contact us. Remember to keep a file for medical expenses.

If you itemize your deductions for a taxable year on Form 1040, Schedule A, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and dependents. For more information, see Questions and Answers: Changes to the Itemized Deduction for 2014 Medical Expenses on www.IRS.gov.

Month: May 2015

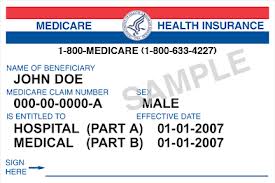

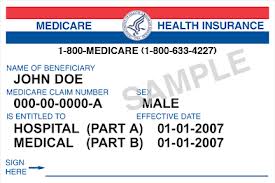

New Rules on the Horizon for Medicare Cards

It is official and about time! Medicare will no longer use your Social Security number on your Medicare card. I have been telling people for years not to carry their Medicare card unless necessary since it contains your Social Security number. With feedback from providers and the spike in identity theft, Medicare has decided that it makes sense to change the current practice.  The change is coming a bit late compared to the rest of the industry. Private insurance companies no longer use Social Security numbers to identify card holders, and the federal government has also forbidden insurers from using the numbers on insurance cards when medical or drug benefits are provided through Medicare contracts.

The change is coming a bit late compared to the rest of the industry. Private insurance companies no longer use Social Security numbers to identify card holders, and the federal government has also forbidden insurers from using the numbers on insurance cards when medical or drug benefits are provided through Medicare contracts.

This new change will take time to implement. Medicare has up to four years to start issuing the new cards, and four more years to reissue current cards.

Healthcare Paperwork: Is yours in order?

Healthcare distortion can involve a host of medical and legal complications. At best, these issues may affect you financially; at worst, they could mean the difference between life and death. Whether you go to the hospital for a routine procedure or for an emergency, there are  steps you can take to help avoid complications.

steps you can take to help avoid complications.

- Is your Medical POA or Advanced Medical Directive (“Living Will”) up to date?

- Make sure your name and all other personal information is completely accurate at each doctor’s appointment, outpatient surgery, and/or hospitalization.

- Have you read and do you understand your health insurance coverage?

- Are you saving documents and bills you receive regarding your health care?

- Does your personal representative have current copies of your directives and documents?

Educational event at Woodhead Insurance July 18th at 10am — come learn more RSVP

Is retirement in your near future?

Woodhead Insurance, in partnership with Hellenbrand Financial, is hosting an event on July 14th and 16th at NWTC. This informative event is meant to help people learn what they need  to know as they head into retirement.

to know as they head into retirement.

It will teach attendees:

Basics of Medicare:

How to enroll

How it works

What it covers

When to sign up

When to delay enrollment

Retirement 101:

Social Security – How to get maximum benefits

Annuities – The different types, the positives and negatives of each

Long Term Care – Learn how different programs work, and about new “hybrid” options

This event is free and open to the public. It is not a sales pitch and there is no obligation. Space is limited, however, so your reservation is required. Please call the office at (920) 544-0058 to RSVP.

News from the Woods

With the weather finally warming here in Wisconsin, Spring brings a time of change. At Woodhead Insurance, we would like to remind you of the importance of notifying us of any life changes you may have. Changes in your life can have an effect on many things, including insurance. Notifying us of these life changes allows us to make sure your health insurance continues to serve you. If you are not sure, call us at 920-544-0058! We’d love to hear from you and celebrate life’s milestones together. Remember we don’t always receive your notices so you have to let us know if you want us to help.

As your advocates, we want to make sure your benefits are protected and that updates are made promptly and accurately. Ensuring you get the most bang for your insurance buck, we offer a host of products around health insurance such as: accident policies, funeral trusts, simple life insurance, dental coverage, and a legal protection plan. You already know we don’t pressure anyone to purchase our products. A good product does not require a pushy salesperson, so feel free to give us a call and, “Window Shop” any of our products. Find out the benefits and costs so you can make your own decision. Being an independent agent, we have a vast network of reputable companies and products. If we don’t carry what you need, we can recommend a reputable and trustworthy provider to assist you. Happy Spring! Diane Woodhead