View and download our Privacy Policy here. This notice explains how Woodhead Insurance Services LLC may collect, use and share your information. Please read it carefully and contact your assigned agent if you have any questions.

Category: Uncategorized

Prescription Drug Provisions in the Inflation Reduction Act

Inflation Reduction Act – effect on Part D of Medicare

original post can be found at https://www.kff.org/slideshow/what-are-the-prescription-drug-provisions-in-the-inflation-reduction-act/

HHS Extends Public Health Emergency Another 90 Days

HHS extended the public health emergency by an additional 90 days, setting a new expiration date of July 15. This impacts several areas, including the “Medicaid unwinding” that is widely anticipated to take place at the end of the public health emergency. In the announcement of the extension, HHS said it would give states 60 days’ notice prior to termination or expiration of the emergency.

Under the public health emergency, the federal government has been paying for tests, vaccines and certain treatments for those covered by its Medicare and Medicaid health insurance programs. The government also required private insurers to cover the full cost of tests and vaccines for the duration of the public health emergency. This means that, once the emergency comes to a close, these benefits will no longer be available.

There is also a fund for those who are uninsured, but the fund will soon be depleted unless Congress allocates more. The Biden administration requested that Congress include $15 billion in COVID-19 relief provisions in the $1.5 trillion omnibus bill that was passed in March, but Congress could not reach an agreement and declined to include such provisions. According to a statement from the White House, these provisions would have maintained the nation’s testing capacity and financed the uninsured fund.

Another important aspect of the public health emergency is how it impacts Medicaid recipients. A federal mandate instituted toward the beginning of the public health crisis dictates that anyone enrolled in Medicaid cannot lose coverage during the pandemic. Prior to the public health crisis, states regularly evaluated whether residents still qualified for the safety-net program. The pandemic has suspended those routines for the past two years, leading to record-high enrollments across the country. While April 16 was the anticipated end to the public health emergency, this week’s extension means that any “unwinding” has been delayed until mid-July.

NAHU members play a crucial role in getting uninsured Americans covered, with 61 percent of ACA exchange enrollments this past OEP having been facilitated through an agent or broker. With millions of Americans on Medicaid potentially losing coverage starting in July, agents and brokers stand at the forefront to assist those that may now be eligible for a subsidy in the exchange. NAHU and the NAHU Education Foundation will be releasing resources to keep you informed and help you get folks covered.

The federal government also announced this week the extension of the nationwide face mask requirement for public transit for another 15 days from when it was scheduled to expire. Travelers will still need to mask up in airports, on planes, buses and trains and at transit hubs until May 3; this is likely to be extended again.

2021 Wisconsin Act 73

2022 Changes to Wisconsin Statues regarding Health insurance

Madison, Wis. — The Wisconsin State Legislature has concluded its work for the 2021-23 Legislative Session during which the Office of the Commissioner of Insurance (OCI) supported several important measures that were passed into law.

On March 26, 2021, Governor Evers signed 2021 Wisconsin Act 9 into law at a community clinic in Wausau. Act 9 created licensing and practice requirements for pharmacy benefit managers (PBMs). The new law requires a PBM doing business in Wisconsin to be licensed by OCI. The law also requires PBMs to submit annual reports on the amount of rebates received from drug manufacturers and what percentage of those rebates were retained by the PBM rather than being passed on to consumers as cost savings. Under the law, OCI is authorized to require PBMs to submit reports or undergo examinations in order to prevent misconduct and protect consumers. Additionally, the law prohibits gag clauses that prevent pharmacists from informing patients about more affordable medication options.

“In an effort to improve prescription drug price transparency and accountability, Governor Evers’ Task Force on Reducing Prescription Drug Prices recommended increasing oversight of pharmacy benefit managers,” said Commissioner Houdek, who served as chair of the Task Force. “OCI has worked to successfully implement these new PBM regulatory requirements, and we will continue to utilize our authority to protect consumer access to affordable prescription drugs.”

In July of 2021, Governor Evers signed 2021 Wisconsin Act 73 into law to strengthen consumer data protections by imposing new information security requirements on the insurance industry. The law defines the security measures that Wisconsin insurance companies must take to protect consumer information. Under the new law, insurance companies must develop a cybersecurity program based on their individual risk assessment and notify policyholders and OCI of large data breaches. Act 73 is based on model legislation developed by the National Association of Insurance Commissioners (NAIC) incorporating input from other state insurance commissioners, industry stakeholders, and consumer representatives.

Governor Evers signed 2021 Wisconsin Act 114 into law in December 2021 which included several changes to insurance statutes. One important provision of Act 114 increases the forfeiture that OCI can impose for violations of insurance law that are targeted at a senior or adult at risk. If the violation specifically involves a consumer who is an adult at risk or an individual who is at least 60 years of age the Commissioner is authorized to require a forfeiture up to $5,000 per violation.

To conclude the session, Governor Evers signed 2021 Wisconsin Act 260 into law in April 2022. Act 260 strengthens state law to ensure that before an annuity is sold, it is considered to be in the best interest of the consumer. Under this law, before a financial professional recommends an annuity to a consumer, they must first disclose their role in the transaction and any material conflict of interest. Financial professionals are also required to document their recommendation and justification in writing to ensure that they made the recommendation to address the consumer’s needs and objectives. This law provides additional consumer protections by creating a higher standard for selling annuities.

Supreme Count Decision 2021- Affordable Care Act

Back when the ACA was originally passed, it included an “individual mandate” which imposed a penalty on people for not having health insurance. Many argued that Congress did not have the constitutional authority to compel people to purchase health insurance. In 2012, the NFIB v. Sebelius case determined that such constitutional authority exists in the “tax and spend” clause that allows Congress power to levy taxes.

Then, in 2017 the Trump administration reduced the tax to $0, which then raised a question whether it could be called a tax. If not, it could no longer be propped up by the ruling in NFIB. Many argued that this action undercut the law’s legitimacy and rendered it unconstitutional. This was the central argument in California v. Texas, decided June 17th. Instead of providing a ruling on whether the ACA could stand as modified, the Supreme Court held that the plaintiffs lacked eligibility to bring the case, leaving the ACA intact but still vulnerable.

https://www.supremecourt.gov/opinions/20pdf/19-840_6jfm.pdf — full court opinion here

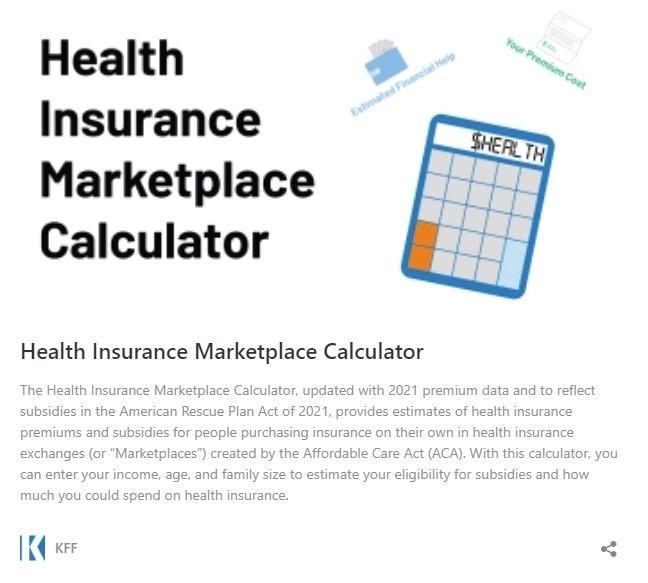

Want a sneak peek at the new rates effective 5/1?

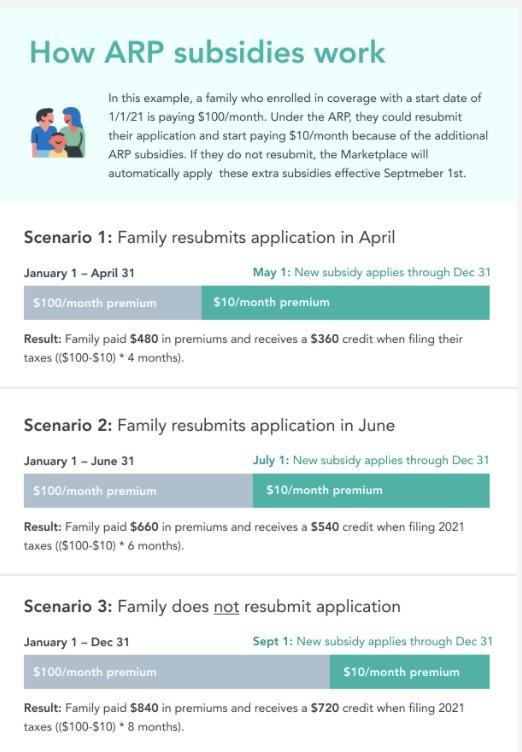

Here is the calculator to check rates with the April first updates (applied May first). If you do nothing, don’t worry you will get them when you file your 2021 tax return.

To our customers call us at 920-544-0058 to apply changes as the application can be tricky and we want to make sure everything the way it should be for you!

American Rescue Plan APTC Changes

Important update on the recently passed American Rescue Plan for members who may be impacted. Passed on March 11, the American Rescue Plan includes provisions that reduce how much members pay for their health insurance coverage in the Marketplace.

Previously the amount of money an individual or family was expected to contribute to their health insurance premiums was capped at 9.83% of the household income. Under the new law, that percentage decreases to 8.5%. All income caps have been removed until 2023.

On April 01, 2021

On-exchange Members have two options.

1.) Call us and let us know that you want to update Information between April 1- May 15, 2021.

• On-exchange members are able re-run or to have their agent re-run your eligibility report to receive the additional tax credits or subsidies. If you are a client, we want to help to make sure everything is done correctly.

• You can select the same plan you are currently enrolled in or can choose a new plan.

• What you have spent towards your deductible and out-of-pocket costs will transfer if they stay on the same plan but might not if you move your plan.

2.) It is okay if you do nothing. If you choose not to update your information but are eligible for additional tax credits or subsidies, they will be reconciled at tax time in 2022.

• You may be eligible to receive a refund if you overpaid.

In either instance, any additional tax credits from January 1- to April 1 will be retroactively applied and reconciled for you when you file your taxes in 2022.

Off-exchange individuals may also want to see if you are newly eligible for tax credits or subsidies beginning April 1.

Off-exchange individuals will need to schedule a phone conference or come in for an appointment to check their eligibility. If you are eligible for a tax credit or subsidy and enroll in a new plan, we will help you cancel/term your existing off-exchange plan.

For additional information, please review this CMS fact sheet. We will share any updates as we receive them.

Please feel free to call or email us with questions (920) 544-0058.

Best Regards,

Diane Casey and Jonathan.

Woodhead Insurance Services LLC