Did you know that if your employer group plan is small, delaying the Part B enrollment could create a penalty?

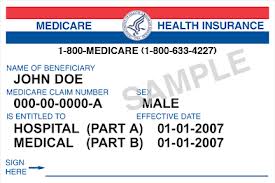

When you are eligible for Medicare usually at 65 you are required to maintain creditable coverage or enroll into the Medicare program with parts A, B, & D. In most situations employer group is considered creditable and you can delay the enrollment and stay on the group plan, but not always.

You may want to wait to sign up for Medicare Part A (hospital service) and/or Part B (outpatient medical services) if you are working for  an employer with more than 20 employees when you turn 65, and have healthcare coverage through your job or union, or through your spouse’s job. COBRA is not considered employer group coverage.

an employer with more than 20 employees when you turn 65, and have healthcare coverage through your job or union, or through your spouse’s job. COBRA is not considered employer group coverage.

*If you are disabled under 65 and working (or you have coverage from a working family member), the Special Enrollment Period rules also apply as long as the employer has more than 100 employees.

When deciding to delay your Medicare enrollment it is important to determine if you will qualify for Special Enrollment Period (SEP).

You can get a Special Enrollment Period to sign up for Parts A and/or B:

• Any time you are still covered by the employer or union group health plan through your or your spouse’s current or active employment, OR

• Within 8 months following the month the employer or union group health plan coverage ends or when the employment ends (whichever is first).

If you wait longer, you may have to pay a penalty when you join.

When in doubt it is important to schedule an appointment with the local social security office and have them assist you in making the best decision for you.

Month: September 2017

Stay local it really matters

Don’t Be Scared… we’ve got you! Health insurance can be overwhelming and scary at times. There are plenty of commercials, online ads and even people that go door to door. Many times these situations use scare tactics, trying to push you towards a provider or plan that may not be your best option. Never be afraid to say “no” or feel like you have to provide personal information to someone you are not comfortable with.

While there is a lot of informatio n available to consumers, it can be difficult to interpret. There is no need to feel intimidated; this is where your local agent can help you. An agent should be there for you, to educate you on your options, help with issues and give you peace of mind; not only the day of your appointment but for years ahead.

n available to consumers, it can be difficult to interpret. There is no need to feel intimidated; this is where your local agent can help you. An agent should be there for you, to educate you on your options, help with issues and give you peace of mind; not only the day of your appointment but for years ahead.

Whether you have a simple question, or would like to stop by for an appointment please feel free to call our office 920-544-0058! We are here to help you.