Changes have been made to make this a more enticing option. Health Reimbursement Arrangements (HRAs), an employer-funded benefits option since the 1970s, will undergo an extensive transformation beginning in January 2020.

An HRA is a type of benefits arrangement in which employers reimburse employees for health insurance expenses like monthly premiums, deductibles, and out-of-pocket medical costs. Both sides of this agreement receive tax benefits, as businesses can claim a tax deduction for the reimbursements and employees are reimbursed for eligible expenses tax-free.

This allows the employer to help fund the cost of healthcare but not take on the administration of the benefits. It gives the employee more freedom to choose a plan that works with their provider of choice, but to ensure that the employee understands the plan and benefits, it is helpful to work with an agent. The health insurance agent will educate and assist your employee to find the right plan for them.

It is not right for all businesses or all employees and there can be pit falls that you will need to comprehend prior to making this decision. Employees cannot use tax credits for health insurance and get employer sponsored payments. For some employees this would push them to higher deductibles. An evaluation would need to be done by an agent. Woodhead Insurance Services LLC is here to help.

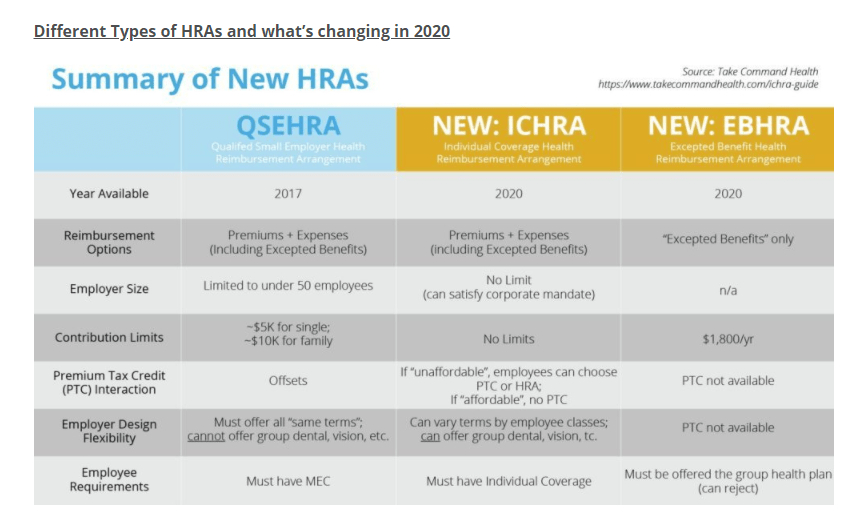

Individual Coverage Health Reimbursement Arrangement (ICHRA): In June 2019, the Trump administration finalized new HRA rules that will create two new types of HRAs for 2020. ICHRA, like QSEHRA, will enable businesses to reimburse employees for premiums and other qualified expenses, but there are key differences between the two. ICHRA regulations include the following core features:

- Businesses of any size will be eligible to offer ICHRAs.

- No restrictions on the annual amount employers may reimburse employees.

- Businesses may offer varying terms, and reimbursement allotments, to different employee classes (such as full-time, part-time, seasonal, non-salaried, etc.).

- ICHRAs enable large employers to fulfill the Affordable Care Act’s employer mandate, which requires them to offer affordable, minimum essential health coverage to at least 95 percent of their full-time employees.

- ICHRA terms must remain uniform among employees of the same class, except that businesses may alter allotments based on the employee’s age or the number of dependents. ICHRA contributions, in order to satisfy the employer mandate, must provide employees an opportunity to purchase “affordable” individual market plans. According to the IRS, an ICHRA is considered affordable if “the remaining amount an employee has to pay for a self-only silver plan on the exchange is less than 9.86% of the employee’s household income.”

- ICHRA beneficiaries must maintain individual health coverage, through purchasing on-exchange or off-exchange insurance plans.

Excepted Benefit Health Reimbursement Arrangement (EBHRA): Also coming to the 2020 HRA environment are EBHRAs, another component of the recent Trump administration directive. EBHRAs allow employers to contribute up to $1,800 per year toward their employees’ expenses that are not covered by their group plan. These types of HRAs can be used to reimburse employees for expenses such as short-term insurance and dental, vision and home care, among other certified costs. Under EBHRA regulations, these employers must also offer a group health plan.

How will the new HRA landscape — particularly the arrival of ICHRA — impact employers and employees? What about HR platforms and InsurTech companies?

It’s expected that the new HRA rules, especially the availability of ICHRAs, will transform the employer-sponsored health insurance market by transitioning employees from group plans to the individual market. For employers, this lessens their administrative burden. For employees, this means more personal choice and greater control of their insurance options.

With more businesses eligible to offer HRAs, it’s likely the individual market will grow substantially over the next few years. And, millions of employees will experience shopping for and enrolling in on-exchange and off-exchange individual plans for the first time.

According to a U.S. Departments of Health and Human Services, Labor, and the Treasury estimate, it will take employers around five years to fully adjust to the updated rule, at which time roughly 800,000 businesses will offer ICHRAs. This, the departments’ modeling suggests, will cover about 11 million employees and family members.

The White House calculates that, as an effect of the new directive, the size of the individual market could increase by as much as 50%.

Woodhead Insurance Services it here to help you with your employee needs as they shop for a plan for themselves or their families. Call us today to learn more. 920-544-0058